Table of Contents

The emergence of decentralized physical infrastructure networks and decentralized artificial intelligence demands a paradigm shift in how digital assets are valued.

Covering the need for this shift and its implications, Yuma recently published the "Fundamental Value Analysis for Bittensor Subnet Tokens" report.

In this blog, we will be covering the key takeaways from the report, as well as adding our personal view on why fundamental analysis will be adopted by institutions this year.

The Theoretical Necessity of Fundamental Analysis in Crypto Assets

Historically, the cryptocurrency market has been dominated by technical analysis and sentiment-driven speculation, in which price action often decouples from a protocol's underlying utility.1 However, as the ecosystem matures into what analysts describe as the "Industrial Utility Era," the requirement for a rigorous fundamental analysis framework has become paramount for institutional and professional capital allocation.3

The Bittensor network, characterized by its modular subnet architecture, serves as a primary case study for this transition, requiring investors to evaluate tokens not merely as speculative vehicles but as direct replacements for corporate operational expenses.5

Fundamental analysis provides a mechanism to look beneath the surface of market volatility and assess the intrinsic value of a project based on tangible facts and economic quality.1

In the context of decentralized networks, this involves a comprehensive evaluation of use cases, underlying technology, team credibility, and, most crucially, on-chain metrics that reflect actual adoption.1 For a long period, the lack of real-world application support led to the proliferation of "air" tokens, but the maturation of infrastructure now allows for the separation of high-quality projects from speculative noise.2

The volatility inherent in the crypto market is often a function of the relative youth of the asset class and the concentration of speculative participants.1 Fundamental analysis mitigates this risk by providing a structured way to identify whether a token is overvalued or undervalued relative to its growth potential.1

Unlike traditional equities, where value is derived from balance sheets and income statements, the value of decentralized networks is often anchored by network effects, token utility, and ecosystem growth.1 For investors, fundamental analysis answers the fundamental "why" behind a project's value, moving beyond historical price patterns to evaluate the problem the technology solves and its long term sustainability.1

Distinguishing Utility from Speculation

A core component of fundamental analysis is the distinction between fundamental value and speculative value. Fundamental value is driven by the natural incentive to transact for a purpose beyond direct financial gain this case, paying for specialized work such as compute, data curation, or model training.5 Speculative value, by contrast, is the expectation of direct financial gain from holding the asset.5 Without a fundamental economic need for the asset to exist, speculation is unlikely to sustain value over a full market cycle.2

Now in 2026, the focus has shifted toward the "Industrial Utility" of subnets.3 Subnets that fail to innovate or produce measurable outputs are increasingly excluded from the network's rewards, a process described by the community as "Digital Darwinism".3 This purge mechanistically rotates capital from generalist subnets toward specialized high compute leaders that provide clear economic advantages over centralized alternatives.3

The evolution of decentralized physical infrastructure networks further highlights the requirement for fundamental analysis. These networks crowdsource global resources, such as GPUs, sensors, and bandwidth, to build infrastructure more efficiently than traditional corporations.9 Because these networks bridge the digital and physical economies, they require valuation tools familiar to traditional finance, such as cash flow modeling and cost to serve benchmarks.15

Anatomy of the Bittensor Subnet Ecosystem

To apply a fundamental valuation framework to Bittensor subnet tokens, one must first comprehend the structural roles within the network.

Bittensor is a decentralized intelligence marketplace where participants collaboratively train and utilize machine learning models via specialized subnets.16 Each subnet functions as an independent, incentive-based competition marketplace producing a specific digital commodity, such as machine intelligence or storage.17

The architecture is built upon the interaction between three primary stakeholders: subnet owners, miners, and validators.19 Subnet owners are responsible for managing the subnet and defining the incentive system.19 Miners execute the assigned tasks using their computational models, and validators evaluate the results, submitting ratings that determine the distribution of rewards.19 These rewards are denominated in TAO or subnet specific alpha tokens, which are distributed through the Yuma Consensus algorithm.17

The Mechanics of Incentive Distribution

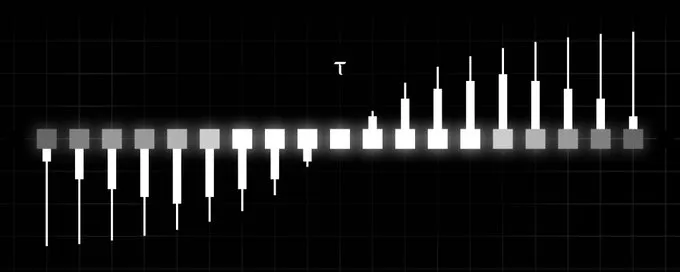

Reward allocation within a subnet is strictly defined to align the interests of all participants. A standard distribution model allocates 18% of emissions to subnet owners, 41% to validators, and 41% to miners.19 This distribution creates a competitive environment where miners are incentivized to optimize their models to earn higher ratings from validators, who in turn are incentivized to provide accurate evaluations to maximize their own rewards.19

The network employs the Yuma Consensus mechanism to resolve rankings from multiple validators into a single emission vector.21 This algorithm protects against collusion and erroneous evaluations by weighting the inputs of trusted validators more heavily and clipping outlier weights that deviate significantly from the consensus.21 The result is a meritocratic system where value is directed toward the most productive members of the network.6

Dynamic TAO and the Alpha Token Economy

The rollout of "Dynamic TAO" (dTAO) in 2025 transformed the economic model of Bittensor by making emissions market-driven and enabling subnets to become directly investible.16

Under this upgrade, each subnet mints its own "alpha" token, which represents a stake in that subnet's specific success.16 TAO holders can swap TAO for these alpha tokens, effectively "voting" with their capital for the subnets they believe provide the most utility.16

The price of an alpha token is determined by an automated market maker (AMM) based on the ratio of TAO in the subnet's reserve to the alpha tokens in circulation.17 This mechanism ensures that subnets with high staking inflows receive more emissions, while those with net outflows see their rewards reduced or eliminated.17 This transition has injected a "growth stock" narrative into the ecosystem, as the market anticipates that the most successful subnets will drive the highest demand for their specific tokens.16

The OpEx Replacement Framework for Subnet Token Valuation

The fundamental valuation methodology proposed by the Yuma Subnet Tokens report 2026 begins with the premise that subnets serve as replacements for specific corporate operational expenses.5

Companies strive to maximize the gap between earnings and expenses, and a rational company will only spend what is required to achieve an operational goal.5 Subnets allow companies to outsource specialized work, such as training an AI model or running inference, to a global fleet of miners rather than hiring internal developers or purchasing expensive hardware.5

Step 1: Forecasting Internal Operational Costs

To value a subnet token, an investor must first estimate the cost of the work the subnet is replacing.5 This assessment uses established methods such as bottom-up analysis, comparable company analysis, or management forecasts.5 If a company historically spends $2,000,000 per year on an engineering team and compute cluster to perform a specific function, that $2,000,000 figure represents the "OpEx replacement value" of the subnet.5

This approach turns expenses into investments.5 Historically, money spent on developer salaries was "gone forever" from the company's balance sheet.5 However, by leveraging a subnet, the company can purchase tokens to facilitate emissions to miners while retaining the underlying asset (the tokens).5 This retention of value changes the corporate calculation from a pure cost center to an asset acquisition strategy.5

Step 2: Translating OpEx into Required Token Emissions

The next step involves determining the token price required to produce an emissions value that compensates miners adequately for the work they perform.5

Miners incur real costs, including hardware, electricity, and data, which creates natural selling pressure as they must monetize their earnings to pay these expenses.5 If the value of emissions is too low, miners will exit the subnet; if it is too high, the company is overpaying for the service.3

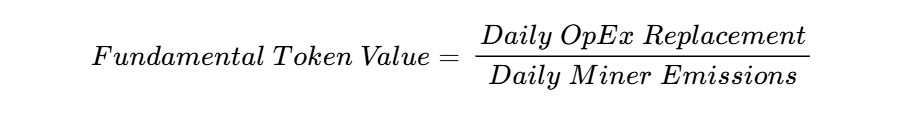

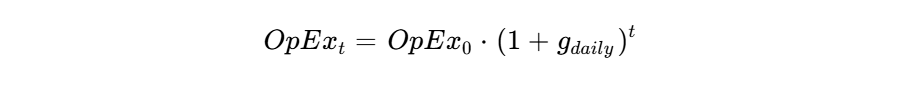

The fundamental token value is derived using the formula:

For example, if the required annual compensation is $2,000,000, the daily replacement cost is approximately $5,479.5 If the daily miner emissions are 2,952 tokens, the fundamental token price required to support those emissions is $1.86 per token.5

Step 3: Integrating Supply Curves and Growth Projections

Because Bittensor has a fixed supply of 21 million tokens and a predefined emission schedule (including halving events), investors can project the required token price at any future date.5 If a company's operational needs are projected to grow, for instance, by 50% annually, the required token price must adjust to maintain the necessary compensation for miners despite the reduction in emissions over time.5

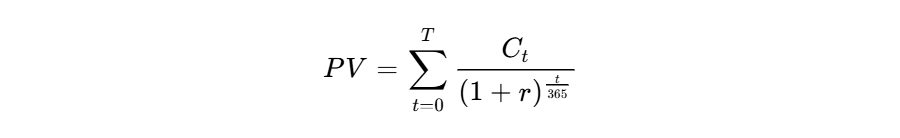

Using daily compounded growth rates, the forward price curve can be calculated:

By mapping these projected costs against the known supply schedule, an investor can derive a forward price curve.5 In the example of a subnet providing $2,000,000 of initial utility with 50% annual growth, the token price required to sustain the network in four years, after accounting for a halving event, would rise from $1.86 to $18.97.5

Advanced Valuation: Present Value of Future Emissions

A comprehensive fundamental analysis must also consider the value generated by staking rewards.5 By applying a discounted cash flow (DCF) model, investors can determine the present value of the tokens they will receive as emissions over their holding period.5

The calculation for the present value (PV) of future emissions is:

where Ct is the required emissions value on day t, r is the annual discount rate, and T is the total holding period.5 Given the high risk nature of decentralized AI protocols, a discount rate of 30% is often utilized to account for technological and execution risks.5

This model allows an investor to calculate the "Total Return" of an investment made today.5 Total return is the sum of the projected principal value (initial tokens multiplied by future price) and the value of all emissions received, minus the original purchase price.5 For an investor purchasing 1,000 tokens at a fundamental price of $1.86 and holding for four years, the total return would include the principal growth to $18,794 plus staking rewards valued at approximately $20,961, totaling $39,755.5

This table demonstrates how the entry price significantly impacts the return profile.5 By identifying the fundamental floor price, investors can avoid the risk of "buying the bubble" and ensure they are allocating capital with a sufficient margin of safety.3

Benchmark Analysis: Subnets vs. Centralized Cloud Infrastructure

A vital part of using the fundamental framework is benchmarking subnet performance against centralized alternatives like AWS Lambda or Google Compute Engine.3 If a subnet provides a service that is significantly cheaper or faster than centralized cloud offerings, it has achieved "Product Market Fit".3

Case Study: Chutes (SN64) Serverless AI Computing

Chutes is a leading inference provider on the Bittensor network that offers serverless compute for developers running AI models.25 Its "instant start" architecture compresses model startup times to 200 milliseconds, which is ten times more efficient than traditional cloud services.34

The fundamental value of the Chutes token is supported by this 85% cost advantage over AWS.34 As revenue from API calls increases, the company (or operator) can support an increasing portion of the token purchases required to maintain the miner incentive price.5

Case Study: Templar (SN3) Distributed AI Training

Templar specializes in the large-scale collaborative training of AI models, lowering the barrier to entry for training models with over 70 billion parameters.34 Traditionally, renting the 512 H100 GPUs required for such a training run would cost approximately $30 million annually through centralized providers.3

On Templar, distributed training can be achieved at 70% lower cost than traditional cloud services and 40% faster than centralized solutions.34 The gap between the $30 million centralized cost and the current cost through token emissions represents the "alpha" or hidden value in the Templar token.3

Case Study: Data Universe (SN13) Decentralized Data Layer

Subnet 13 addresses the critical need for fresh, high-quality social data for AI training.40 While big tech companies strike exclusive licensing deals, such as Google’s $60 million annual agreement with Reddit, SN13 provides a decentralized alternative for scraping data from platforms like X and Reddit.42

The incentive mechanism for SN13 rewards miners based on "Dynamic Desirability," in which TAO holders vote on which topics to prioritize for scraping.41 This ensures that the network produces a commodity that is in high demand, aligning the token's value with its practical utility for research institutions and AI labs.42

Institutional Adoption and the Supply Shock of 2026

Fundamental analysis is increasingly influenced by the entry of institutional capital into the Bittensor ecosystem.25 The launch of the Grayscale Bittensor Trust and filing for spot TAO ETFs signal that professional investors are re-rating Bittensor as a "digital infrastructure platform" rather than a mere speculative asset.44

A significant catalyst for this re-rating is the first halving event, which occurred in December 2025.25 This event reduced daily token emissions from 7,200 TAO to 3,600 TAO, effectively cutting the annual inflation rate from approximately 26% to 13%.29

Implications of Reduced Miner Sell Pressure

Miners typically act as a source of constant sell pressure, as they must cover electricity and hardware costs.5 Before the halving, miners were dumping approximately $2.1 million worth of TAO daily.29 Following the halving, this sell pressure dropped to approximately $1.06 million—a reduction of $30 million per month in tokens hitting the market.29

When this supply shock is met with constant or increasing institutional demand, driven by filings for spot ETFs and corporate treasury allocations, the supply/demand imbalance tilts dramatically in favor of price appreciation.29 Institutional investors often view this scarcity through a "MacroStrategy" lens, acquiring and staking TAO to secure long term access to the network's intelligence outputs.29

Quantitative Metrics and On-Chain Realities

Beyond the OpEx framework, investors should utilize traditional crypto fundamental metrics such as the Network Value to Transactions (NVT) ratio and the Market Value to Realized Value (MVRV) ratio to cross-validate their findings.30

NVT, which compares market capitalization to transaction volume, acts as a price-to-earnings (P/E) analog for digital assets.11 A low NVT suggests that a network is undervalued relative to the actual economic activity occurring on its blockchain.11

In Bittensor, the "Realized Value" is also influenced by the concentration of stake.22 On-chain data indicates that while new wallet growth is increasing, ownership in the top percentiles is compressing, with large holders staking their tokens rather than distributing them to the market.48 This compression of the "liquid float" means that even small demand shocks can result in significant price movements, as institutions are forced to compete for a shrinking supply of liquid TAO.35

The Role of Subnet Power Laws

The "Digital Darwinism" mentioned in community discussions implies a power law distribution of value across subnets.3 High-value subnets like NATIX’s StreetVision or NATIX’s CityVision attract the majority of stake and emissions, while underperforming subnets struggle for visibility.52

Investors using the fundamental framework should focus their analysis on these "blue chip" subnets that have a deep technical moat and a mature business model.34 For example, subnets like Hermes (SN82) or BitQuant (SN15) generate measurable outputs and verified volume today, which provides a more stable foundation for valuation than subnets relying solely on future potential.48

Strategic Synthesis and Market Outlook

Fundamental analysis for Bittensor subnet tokens represents a departure from the historical norms of digital asset investing. By treating subnets as operational expense replacements, investors can bridge the gap between speculative digital currencies and industrial-grade software as a service (SaaS).3 This transition to the "Industrial Utility Era" ensures that capital flows to subnets that provide real-world economic advantages, thereby strengthening the entire ecosystem.3

The framework outlined in this analysis provides a systematic way to identify the fundamental floor price of a token, project future returns using discounted cash flow models, and benchmark decentralized performance against centralized cloud giants.3 As the network scales toward 1,024 subnets and institutional access through ETFs becomes a reality, the ability to perform rigorous fundamental analysis will be the defining characteristic of successful market participants.19

Ultimately, the value of Bittensor lies in its ability to turn expenses into investments and coordinate global machine intelligence as a tradable commodity.5 For professional peers in the investment community, the integration of these fundamental principles is not merely a strategy but a necessity for navigating the complexities of the decentralized intelligence economy in 2026 and beyond.1

FAQs

What is the “Industrial Utility Era” in crypto?

The Industrial Utility Era refers to a shift away from narrative- and sentiment-driven speculation toward valuing crypto assets based on measurable, real-world utility. In this phase, tokens are evaluated as infrastructure inputs that replace corporate operational expenses rather than purely speculative instruments.

Why is fundamental analysis becoming more important in crypto markets?

As decentralized infrastructure matures, price action increasingly reflects actual usage, revenue generation, and cost replacement. Fundamental analysis provides a framework to assess intrinsic value using adoption metrics, token utility, emissions, and on-chain economic activity rather than short-term market sentiment.

How is Bittensor different from earlier speculative crypto models?

Bittensor’s subnet architecture produces measurable digital commodities such as inference, training, or data. Tokens are used to pay for these services, effectively acting as substitutes for traditional corporate operating expenses like cloud compute or engineering labor.

What does it mean to value a token as an OpEx replacement?

Valuing a token as an operational expense replacement means estimating the real-world cost the subnet replaces, such as cloud infrastructure or AI training budgets. The token’s fundamental value is derived from the price required to sustain miner compensation for delivering that service.

What are Bittensor subnets and why do they matter for valuation?

Subnets are independent, incentive-driven marketplaces within Bittensor, each producing a specific output like inference, data, or training. Because each subnet has distinct economics, valuation must be performed at the subnet level rather than treating TAO as a monolithic asset.

Who are the key participants in the Bittensor ecosystem?

The ecosystem consists of subnet owners who define incentive rules, miners who perform computational work, and validators who evaluate outputs. Rewards are distributed in TAO or subnet-specific alpha tokens based on performance and consensus.

How does Yuma Consensus affect subnet valuation?

Yuma Consensus aggregates validator evaluations into a single emissions vector while reducing the impact of collusion or outliers. This ensures that rewards flow to the most productive participants, reinforcing a merit-based valuation model.

What is Dynamic TAO (dTAO) and why is it important?

Dynamic TAO introduced subnet-specific alpha tokens and made emissions market-driven. TAO holders allocate capital to subnets by staking into alpha pools, causing emissions to flow toward subnets with real demand and measurable utility.

How are subnet alpha token prices determined?

Alpha token prices are set by an automated market maker based on the ratio of TAO in a subnet’s reserve to alpha tokens in circulation. Increased demand for a subnet raises its reserve, emissions, and token valuation.

What is “Digital Darwinism” in the Bittensor ecosystem?

Digital Darwinism describes the process by which underperforming subnets lose emissions while high-utility subnets attract capital and rewards. This mechanism reallocates value toward specialized, high-performance infrastructure providers.

How can investors estimate the fundamental price of a subnet token?

The framework starts by estimating the real-world cost the subnet replaces, then calculating the token price required to sustain miner emissions. Supply schedules, halving events, and growth projections are used to model forward price curves.

Why do halving events matter for Bittensor valuation?

The December 2025 halving reduced daily emissions from 7,200 TAO to 3,600 TAO, cutting inflation roughly in half. This reduced miner sell pressure while demand from institutions increased, creating a supply-demand imbalance.

How does institutional adoption change TAO’s market dynamics?

Institutional vehicles such as trusts and ETF filings reframe TAO as digital infrastructure rather than a speculative asset. Institutions often stake TAO for long-term access, further reducing liquid supply.

What role do on-chain metrics like NVT and MVRV play?

Metrics such as Network Value to Transactions (NVT) and Market Value to Realized Value (MVRV) help cross-validate whether market capitalization aligns with real economic activity. These act as analogs to traditional valuation ratios.

Why do power laws emerge across Bittensor subnets?

Value tends to concentrate in subnets with strong technical moats, proven outputs, and sustained demand. High-performing subnets attract disproportionate stake and emissions, reinforcing long-term dominance.

What is the long-term thesis for Bittensor valuation?

Bittensor’s long-term value lies in its ability to turn expenses into investments by coordinating global machine intelligence as a tradable commodity. Fundamental analysis enables investors to identify sustainable subnet economics in an increasingly institutional market.

Works cited

- Understanding Fundamental Analysis In Crypto ZebPay, accessed January 23, 2026, https://zebpay.com/blog/what is fundamental analysis in crypto

- Crypto's New Math: From Narratives to REV Sei Blog, accessed January 23, 2026, https://blog.sei.io/research/cryptos new math from narratives to rev/

- The End of Magic Tokens: Why Yuma 2026 Changes Everything for Subnet Valuation : r/bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/comments/1qju7it/the_end_of_magic_tokens_why_yuma_2026_changes/

- Das Ende der Magic Tokens: Warum Yuma 2026 alles für die Subnet Bewertung ändert : r/bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/comments/1qju7it/the_end_of_magic_tokens_why_yuma_2026_changes/?tl=de

- Yuma_Subnet_Tokens_Report_2026.pdf

- Bittensor Report Squarespace, accessed January 23, 2026, https://static1.squarespace.com/static/67da4a9c0a538e01710294cb/t/69387ae7405a983977d4dcaf/1765309326879/The+Investment+Case+for+Bittensor

- Cryptocurrency Fundamental Analysis: A Comprehensive Guide (2025) Zignaly, accessed January 23, 2026, https://zignaly.com/crypto trading/analysis based strategies/cryptocurrency fundamental analysis

- What is fundamental analysis in crypto and stocks? Definition, approach & use cases, accessed January 23, 2026, https://www.cointracker.io/learn/fundamental analysis

- Leaving the Virtual Bubble Behind? An Introduction to DePIN and Its Hardware Applications, accessed January 23, 2026, https://www.osl.com/en/bits/article/what is depin and how it reshapes physical infrastructure

- Fundamental Analysis In Crypto Trading: Guide For Investors Trakx, accessed January 23, 2026, https://trakx.io/resources/insights/fundamental analysis in crypto trading/

- DeFi Token Valuation: Key Metrics, Tokenomics, and Case Studies | CryptoEQ, accessed January 23, 2026, https://www.cryptoeq.io/articles/defi fundamentals valuation

- What are fundamental analysis and technical analysis? Coinbase, accessed January 23, 2026, https://www.coinbase.com/learn/crypto basics/what are technical analysis and fundamental analysis

- DePIN's New Phase: From Speculation to Sustainable Business Models | ForkLog, accessed January 23, 2026, https://forklog.com/en/depin after the boom revenue is king as energy and ai set the pace/

- The Real World: How DePIN Bridges Crypto Back to Physical Systems | Grayscale, accessed January 23, 2026, https://research.grayscale.com/reports/the real world how depin bridges crypto back to physical systems

- From Hype to Fundamentals: A Case Study of Helium & DePIN | by Hilary H Brown | Medium, accessed January 23, 2026, https://medium.com/@hilary.h.brown/from hype to fundamentals helium depin 4bc466e868d4

- IBS Insight — Bittensor (TAO). Decentralized Intelligence at the… Inter Blockchain Services, accessed January 23, 2026, https://ibsvalidator.medium.com/ibs insight bittensor tao 24209f44cfb2

- Understanding Subnets Bittensor Docs, accessed January 23, 2026, https://docs.learnbittensor.org/subnets/understanding subnets

- AWS vs. Bittensor: The Battle for Affordable GPU Power YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=kPgjEpGjwZ4

- Bittensor (TAO) : A comprehensive presentation of a protocol combining AI and blockchain | OAK Research, accessed January 23, 2026, https://oakresearch.io/en/reports/protocols/bittensor tao presentation protocol combining ai blockchain

- Announcing Precog: Coin Metrics' Bittensor Subnet for Premium Market Insights, accessed January 23, 2026, https://coinmetrics.io/company news/precog coin metrics bittensor subnet/

- Yuma Consensus Bittensor Docs, accessed January 23, 2026, https://docs.learnbittensor.org/learn/yuma consensus

- Bittensor Protocol: The Bitcoin in Decentralized Artificial Intelligence? A Critical and Empirical Analysis arXiv, accessed January 23, 2026, https://arxiv.org/html/2507.02951v1

- Comprehensive Analysis of the Decentralized AI Network Bittensor RootData, accessed January 23, 2026, http://www.rootdata.com/news/266643

- How Yuma Consensus 3 Makes Bittensor More Fair, accessed January 23, 2026, https://docs.learnbittensor.org/learn/yc3 blog

- Bittensor on the Eve of the First Halving Grayscale Research, accessed January 23, 2026, https://research.grayscale.com/reports/bittensor on the eve of the first halving research

- Bittensor's Hidden Growth Engine: The Rise of Subnets | by Greythorn Asset Management, accessed January 23, 2026, https://0xgreythorn.medium.com/bittensors hidden growth engine the rise of subnets eddf24e96a60

- Emission Bittensor Docs, accessed January 23, 2026, https://docs.learnbittensor.org/learn/emissions

- Crypto Tokenomics: How To Evaluate a Crypto Project? Nonbank, accessed January 23, 2026, https://nonbank.io/blog/crypto tokenomics

- Bittensor's Historic First Halving Starts December 12, Will TAO Rally To $1,000 As Daily Emissions Drop 50%? MEXC Blog, accessed January 23, 2026, https://blog.mexc.com/news/bittensors historic first halving starts december 12 will tao rally to 1000 as daily emissions drop 50/

- Digital Asset Valuation Models: A Framework for Traditional Portfolio Managers, accessed January 23, 2026, https://blog.amberdata.io/digital asset valuation models a framework for traditional portfolio managers

- Guide to Token Valuation Methods: Unique Examples and Strategies Eqvista, accessed January 23, 2026, https://eqvista.com/company valuation/valuation crypto assets/token valuation methods/

- accessed January 23, 2026, https://eqvista.com/company valuation/valuation crypto assets/#:~:text=It%20is%20used%20for%20crypto,assuming%20a%2010%25%20discount%20rate.

- Compare AWS Lambda vs Google Compute Engine on TrustRadius | Based on reviews & more, accessed January 23, 2026, https://www.trustradius.com/compare products/aws lambda vs google compute engine

- Bittensor Subnet Investment Guide: Seizing the Next AI Trend ..., accessed January 23, 2026, https://www.panewslab.com/en/articles/boub1le3

- bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/

- AWS Lambda vs. Google Cloud functions: a comprehensive comparison Modal, accessed January 23, 2026, https://modal.com/blog/aws lambda vs google cloud functions article

- AWS Lambda vs. Google Cloud Functions: Top 10 Differences Lumigo, accessed January 23, 2026, https://lumigo.io/learn/aws lambda vs google cloud functions top 10 differences/

- Top 3 notable subnet ecosystem tokens of Bittensor | Mr Quit123 on Binance Square, accessed January 23, 2026, https://www.binance.com/en/square/post/23267702537041

- Bittensor Subnet Investment Guide: Seizing the Next Wave of AI | PANews on Binance Square, accessed January 23, 2026, https://www.binance.com/en IN/square/post/26964267778329

- Subnet 13 Data Universe | Macrocosmos Developer Guide, accessed January 23, 2026, https://docs.macrocosmos.ai/subnets/subnet 13 data universe

- Data Universe Subnet Alpha, accessed January 23, 2026, https://subnetalpha.ai/subnet/data universe/

- Bittensor Subnet 13 — Data Universe: Decentralised Data Scraping | by Tensorplex Labs, accessed January 23, 2026, https://medium.com/@tensorplexlabs/bittensor subnet 13 data universe decentralised data scraping 3787abfe2ae0

- Macrocosmos: Bittensor's decentralized OpenAI? OAK Research, accessed January 23, 2026, https://oakresearch.io/en/analyses/fundamentals/macrocosmos bittensor decentralized open ai

- Bittensor price today, TAO to USD live price, marketcap and chart | CoinMarketCap, accessed January 23, 2026, https://coinmarketcap.com/currencies/bittensor/

- Investor Sentiment Updates: Institutions Reposition in Bitcoin Mining, accessed January 23, 2026, https://bitcoinminingstock.io/blog/investor sentiment updates institutions reposition in bitcoin mining/

- Bittensor (TAO) Price Prediction 2026 2030: Decentralized AI's Scarcity Play | Coincub, accessed January 23, 2026, https://coincub.com/price prediction/bittensor price prediction/

- Bittensor on the Eve of the First Halving Grayscale Research, accessed January 23, 2026, https://research.grayscale.com/reports/bittensor on the eve of the first halving

- bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/new/

- Today's Crypto Asset Valuation Frameworks | by Ashley Lannquist | Blockchain at Berkeley, accessed January 23, 2026, https://medium.com/blockchain at berkeley/todays crypto asset valuation frameworks 573a38eda27e

- bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/hot/

- bittensor_ Reddit, accessed January 23, 2026, https://www.reddit.com/r/bittensor_/best/

- Latest Bittensor News (TAO) Future Outlook, Trends & Market Insights CoinMarketCap, accessed January 23, 2026, https://coinmarketcap.com/cmc ai/bittensor/latest updates/

- Subnets & Startups on Bittensor Yuma, accessed January 23, 2026, https://www.yumaai.com/subnets

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.