Table of Contents

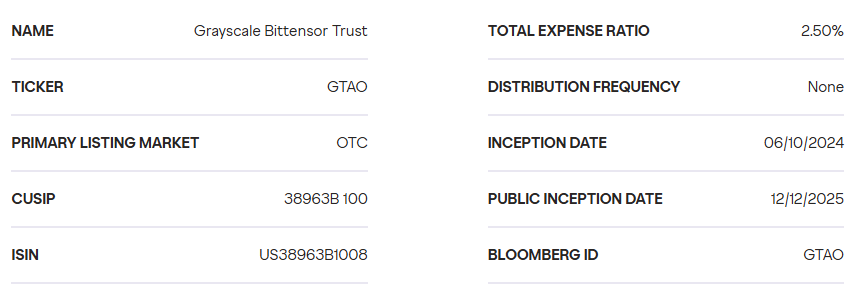

Grayscale announced it has filed an initial S-1 registration statement with the U.S. Securities and Exchange Commission for the Grayscale Bittensor Trust, which trades under the ticker GTAO on OTC Markets. The filing marks the beginning of the formal process to convert the existing trust into an ETP.

If approved, the product would become the first TAO-based ETP in the United States, expanding institutional-style access to Bittensor through traditional brokerage accounts.

A Key Step After Form 10 Effectiveness

The S-1 filing follows several recent milestones for the trust. Earlier this month, GTAO began publicly trading after its Form 10 registration became effective, making it an SEC reporting company and reducing share holding period restrictions.

Grayscale said the S-1 represents the next step in its effort to convert GTAO into a fully listed ETP, similar to the firm’s previous conversions of single-asset crypto trusts into exchange-traded products.

What the Grayscale Bittensor Trust Offers

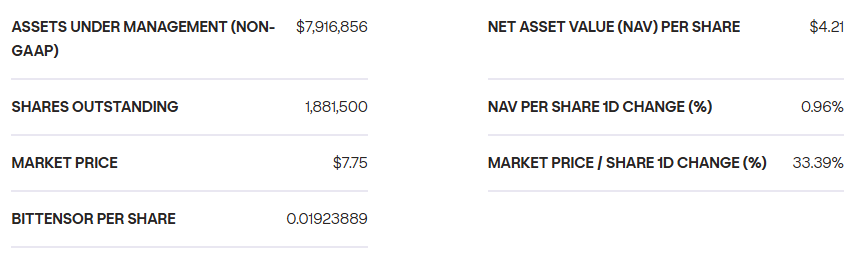

The Grayscale Bittensor Trust is structured to give investors exposure to TAO without requiring them to directly buy, store, or secure the token themselves. Shares are designed to track the market price of TAO, less fees and expenses.

NAV is calculated daily at 4 p.m. ET using the Coin Metrics Real-Time Bittensor Reference Rate, which aggregates spot prices from multiple trading venues.

Why This Matters for TAO

A successful conversion would place TAO alongside a growing list of digital assets accessible via regulated ETP structures in the U.S. market. For Bittensor, it represents another step toward broader institutional visibility at a time when the international AI arms race is continuing to ramp up.

While SEC approval is not guaranteed, the filing itself signals increasing regulatory engagement around TAO-based investment products and positions Grayscale at the forefront of that effort.

Chairman Barry Silbert commented:

Grayscale filed an S-1 for $GTAO, which would be the first Bittensor $TAO ETP in the U.S.

— Barry Silbert (@BarrySilbert) December 30, 2025

Decentralized AI is developing quickly and @Grayscale is pioneering access https://t.co/sYT9vAudOO

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.