Table of Contents

Stillcore Capital, a Bittensor-focused investment fund, released its State of TAO report last week, offering a comprehensive analysis of the Bittensor ecosystem and predicting 2026 could mark a breakthrough year for decentralized AI.

The 22-page report provides an in-depth examination of Bittensor's architecture, subnet economics, and competitive positioning. According to Stillcore, Bittensor has reached an inflection point where infrastructure, wallet accessibility, and subnet maturity are converging to enable mainstream adoption.

"At Stillcore, we suspect we will see one or more breakout subnets in 2026," the report states. "We think at least one Subnet token will reach a market cap of $1B. When that happens, the attention of crypto X will likely swing onto the entire Bittensor ecosystem."

New Wallets Remove Accessibility Barriers

A major focus of the report is the December 2025 launch of two consumer-ready wallets that dramatically lower the barrier to entry for Bittensor participation. The Crucible Labs TAO Wallet and Tao.com's iOS wallet now allow users to buy TAO with credit cards or Apple Pay and trade subnet tokens directly in-app.

Previously, Bittensor wallets were described as "ganky, not consumer-ready, and difficult for consumers (even crypto-savvy consumers) to use or understand," according to the report. This created an insular trading environment limited to roughly 20,000 participants, with total subnet market cap hovering around $1 billion throughout most of 2025.

"This means that EVERYTHING a consumer needs to participate in Bittensor subnets is now in one app. The exchange for $TAO and subnets, plus fiat onramps, are all baked in. There is no need to get a Coinbase or Kraken account or use a website of any kind." - Stillcore Capital

The report argues these infrastructure improvements set the stage for a potential surge in demand, similar to how accessible wallets like MetaMask and Phantom drove Ethereum and Solana adoption.

The 'Most Ferocious Form of Capitalism'

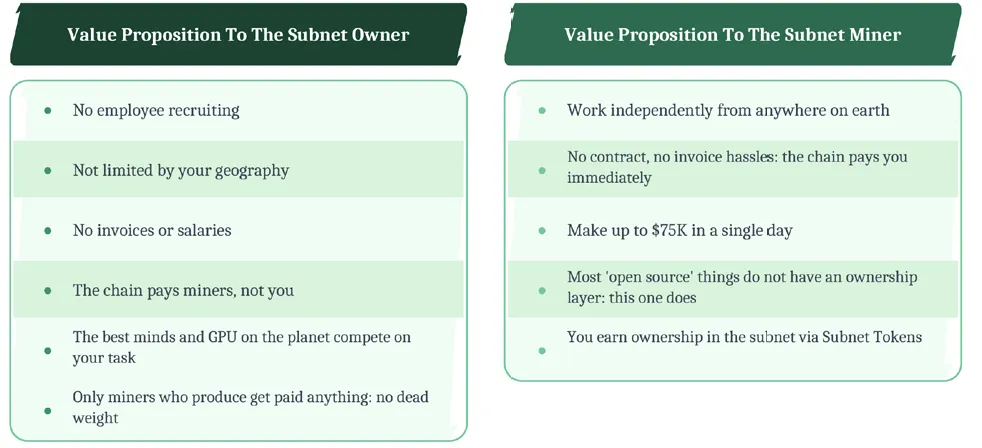

Stillcore describes Bittensor as fundamentally reimagining how companies and labor organize. The network operates through 128 subnets, each functioning as an AI startup where global freelancers compete to complete tasks and earn ownership through subnet tokens.

"We call it the most ferocious form of capitalism yet invented. Everyone competes, always. Only the most excellent get anything. And everyone is re-evaluated continuously: you cannot rest. What you did yesterday does not matter today." - Stillcore Capital

The report highlights several subnets already achieving technical breakthroughs:

Ridges (Subnet 62) has built an AI coding assistant that beats Claude and Cursor on the SWE Benchmark at 1/70th the cost of competitors. The subnet currently has a $50 million market cap, while its centralized competitors are valued between $10 billion and $183 billion.

The economics driving these subnets are remarkable. Stillcore's analysis reveals that top Ridges miners can earn up to $50,000 worth of subnet tokens daily. To put that in perspective, if Ridges eventually matched the valuation of its competitor Cognition Labs at $10.2 billion, those daily mining rewards would be worth over $10 million. It's the same early-mover dynamic that made early Bitcoin miners wealthy.

Targon (Subnet 4) and Chutes (Subnet 64) provide inference at 1/6th the cost of traditional providers, enabling "subnet stacking" where subnets leverage other subnets to compound cost advantages.

Templar (Subnet 3) and IOTA (Subnet 9) are building decentralized AI training networks aimed at rivaling Elon Musk's Colossus data center.

A key finding in the report is what Stillcore calls "subnet stacking," where subnets build on top of each other to create compounding efficiencies. When Ridges taps Targon and Chutes for inference at 1/6th traditional costs, then adds its own development advantages from decentralized competition, the cost savings don't just add up: they multiply across the entire stack.

TAO Halving and Flow Mechanism

On December 15, 2025, Bittensor experienced its first halving, reducing daily TAO emissions from 7,200 to 3,600 tokens. The report draws parallels to Bitcoin's first halving, which preceded an 83x price increase over the following year.

But the more significant change, according to Stillcore, is TAO Flow: a mechanism that fundamentally reshapes how subnets compete for network emissions.

Previously, Bittensor allocated emissions based on subnet token price, creating a backward-looking metric that rewarded past performance. TAO Flow flips this model entirely. Now, subnets compete based on real-time buying pressure: essentially, which subnets are people putting money into right now.

The mechanics are ruthlessly efficient. When users buy a subnet token, they create positive TAO flow. When they sell, they create negative flow. Subnets with sustained negative flow don't just receive reduced emissions: they receive zero emissions and face potential deregistration from the chain entirely.

"It makes sense. Who has the heat? Who has the current attention of the world? Feed that fire. Double down on what's working," the report states.

This creates a dynamic feedback loop. Subnets delivering real value attract buyers, generating positive flow that increases their emissions. Those additional emissions fund more miner rewards, attracting better talent, which drives better performance, which attracts more buyers. Meanwhile, underperforming subnets face an accelerated death spiral: no buying activity means no emissions, which means no miner incentives, which means no development.

The Stillcore team emphasizes this isn't just a technical upgrade: it's a philosophical shift toward radical market efficiency. In traditional crypto projects, teams can coast on early momentum or narrative. TAO Flow eliminates that luxury. Every subnet must continuously earn its place through demonstrated market demand, measured in real-time capital flows.

"It makes sense. Who has the heat? Who has the current attention of the world? Feed that fire. Double down on what's working." - Stillcore Capital

No True Competition

The report asserts Bittensor has no direct competitor, citing its fair launch as a significant moat. Unlike projects backed by venture capital with insider allocations, Bittensor launched similarly to Bitcoin, with no entity owning more than 1% of TAO supply.

Competing projects like Artificial Superintelligence Alliance, GenSyn, and FortyTwo all featured substantial VC funding and team allocations ranging from 20-60% of token supply, according to Stillcore's analysis.

The Road Ahead

Stillcore's competitive analysis reveals a striking advantage: Bittensor has no true peer. The report points out that Bittensor launched fairly: more fairly than even Bitcoin, where Satoshi Nakamoto owns 5.5% of the supply. By contrast, every other decentralized AI project the fund examined had substantial insider allocations. GenSyn took over $43 million from a16z. Projects like Artificial Superintelligence Alliance, FortyTwo, Render Network, and Akash all reserved between 20-60% of tokens for teams and early investors.

Looking ahead, Stillcore sees 10 to 20 subnets with legitimate breakout potential, with 3 to 4 particularly close to mainstream traction. Beyond the headliners like Ridges and Targon, the report highlights Nova (Subnet 68) discovering pharmaceutical compounds, Synth (Subnet 50) which recently turned a $3,000 position into $50,000 through prediction market strategies, and Zeus (Subnet 18) delivering weather forecasting that beats traditional industry models.

"Bittensor is a Y-Combinator that anyone can join," the report concludes, quoting research from Unsupervised Capital. "We agree. And we're betting on it."

The full State of TAO report is available at www.stillcorecapital.com.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.