Table of Contents

According to coverage by Dominic Basulto of The Motley Fool, despite a notable 20 % pullback from its recent high, TAO presents strong catalysts for long-term growth.

Among the key growth factors noted is the rapidly growing interest in AI technologies and Bittensor’s unique position as a decentralized network, making it appealing to both developers and investors seeking exposure to AI advancements.

"For more than three years -- ever since the launch of ChatGPT back in November 2022 -- crypto investors have salivated at the thought of new artificial intelligence (AI)-powered cryptocurrencies with the potential to create multimillionaires."

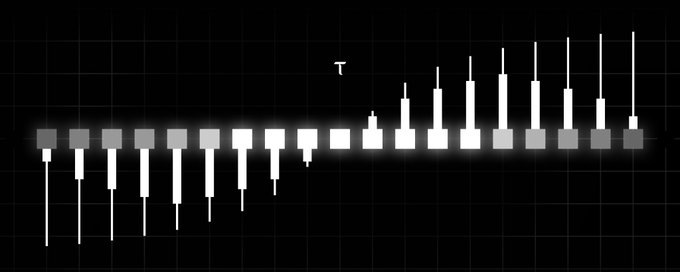

Basulto also notes the significance of Bittensor’s capped token supply. With a maximum supply of 21 million TAO (just like Bitcoin), combined with the recent halving that reduced daily emissions to 3,600 tokens, scarcity is likely to push prices higher over time.

"By way of comparison, AI coins with huge circulating coin supplies trade for mere pennies, and can be safely avoided for now."

This scarcity, along with increasing investor demand, suggests a bullish outlook, especially since Bittensor boasts the largest market cap among AI cryptocurrencies.

Institutional Interest and Regulatory Progress

Another important takeaway is Basulto's emphasis on upcoming financial products that could broaden Bittensor’s investor base. Specifically, his article points to Grayscale’s efforts with GTAO. The team recently announced its filing of an S-1 registration statement with the SEC; if approved, the product would become the first TAO-based ETP in the United States, expanding institutional-style access to Bittensor through traditional brokerage accounts.

Market Implications and Key Insights

In summary, The Motley Fool portrays Bittensor as a promising investment opportunity in the AI sector. The combination of token scarcity, an innovative decentralized network, and GTAO momentum positions TAO as a standout candidate for investors looking to capitalize on the AI x crypto intersection, a niche that has, to a large degree so far, been riddled with scams, poor business models, and investor extraction.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.