Table of Contents

As with Bitcoin, which typically sees a short-term price drop immediately after a halving, $TAO has dropped over 25% since its first halving earlier this month. But, despite the Bitcoin blueprint that shows bullish price action after the dump, which we believe should evoke confidence in everyone, there's been noticeable dismay on the timeline.

We're seeing comments like "[if this line isn't held] things will get really grim" and some bears are running victory laps. But, there's plenty of bullish sentiment to combat the negativity, and many (@CryptoWizardd, @Obsessedfan5, @Senti__23, and @donniexbt, just to name a few) people are calling out what seems obvious to us as we write today: TAO is undervalued, and 2026 will be when we see the impact of the halving truly play out.

But don't just take it from us.

Offering a glimpse at what's next is Grayscale Research's analysis of Bittensor, which was published right before the TAO halving. In this article, we'll provide an overview of the research. We recommend you read the research in its entirety if you have the time to do so.

We agree so much we wrote a research paper about the $TAO Halving here: https://t.co/jPxORW0rBxhttps://t.co/gYIrENCxzk pic.twitter.com/mzrAPhIUQq

— Grayscale (@Grayscale) December 8, 2025

Grayscale's research frames Bittensor as a potential alternative to the trend of AI systems (their capital and power) becoming increasingly concentrated among a small number of large companies, and argues that decentralized AI networks have become increasingly important as questions about control, participation, and economic access in AI intensify.

Let's dive into the main points.

Bittensor’s Position In AI

The AI industry has reached a point where, much to the dismay of freedom lovers globally, private companies and centralization dominate. Instead of AI evolving in the direction of being a public commodity, it's following the path of today's Big Tech giants.

Bittensor is the opposition.

It was created as a decentralized network that gives developers open access to create, train, and use artificial intelligence models. Founded in 2021 through a fair launch and developed by a grassroots community, the network operates as a neutral platform intended to broaden participation in AI development. Grayscale Research compares this role to Bitcoin’s function as an open, neutral system for money.

Read Grayscale's Bittensor overview & investment thesis

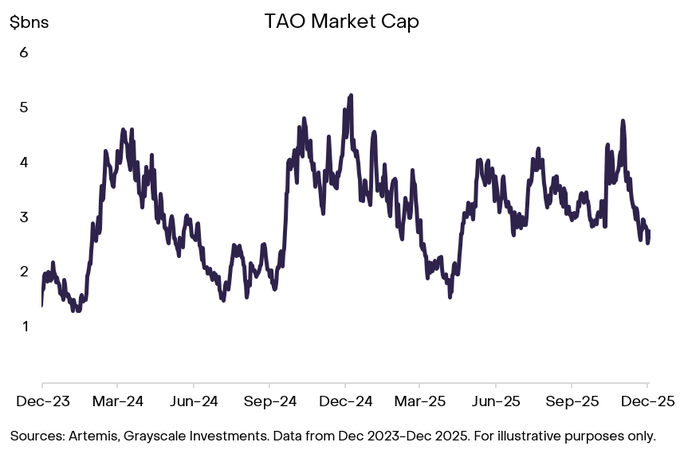

The report notes that Bittensor has grown meaningfully in market cap in recent years, supported by both rising demand for decentralized AI tools and anticipation around TAO’s first halving, which occurred on December 14th this year.

This growth reflects early traction for a model that distributes ownership and decision-making across a wide community rather than concentrating power in centralized providers.

"Bittensor is a decentralized network for artificial intelligence (AI) development — an open network where anyone can create, train, and access AI. Amid growing concentration of capital, power, and decision-making in AI, Grayscale Research believes decentralized alternatives like Bittensor have become essential."

Supply Side: TAO’s First Halving

As is likely clear to everyone already, properly assessing the first TAO halving should involve a Bitcoin comparison. Grayscale points out several key elements to consider:

- BTC emissions incentivize miners to help secure the network, whereas TAO emissions incentivize miners to produce AI-related digital commodities.

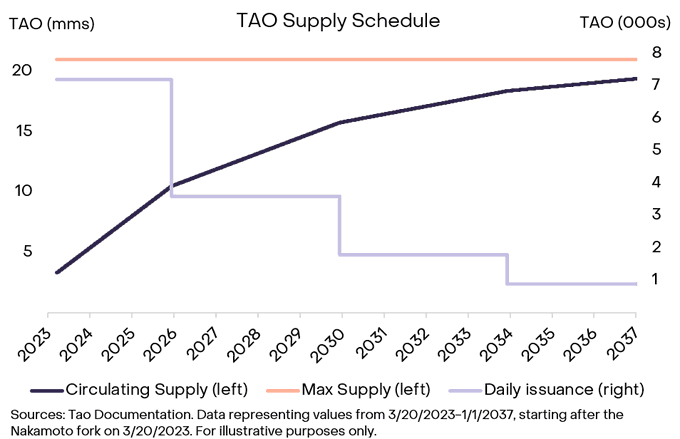

- Bittensor’s native token, TAO, follows the same four-year halving schedule used by Bitcoin, including a fixed maximum supply of 21 million.

- Bittensor’s first halving reduced daily emissions from roughly 7,200 TAO to about 3,600 TAO.

Bitcoin’s own history, Grayscale says, is an example of how reduced supply growth can strengthen a network over time, even as rewards to participants decline. The TAO halving places Bittensor on a similar supply trajectory as it progresses toward its long-term issuance limit.

"Bitcoin’s history shows that reduced supply can enhance network value despite smaller rewards, as its network security and market value have strengthened through four successive halvings. Similarly, Bittensor’s first halving marks a key milestone in the network’s maturation as it progresses toward its 21 million token supply cap."

Demand Side: Rising Adoption and Subnet Growth

The halving arrives at a time when Bittensor is experiencing growing institutional adoption and rapid expansion across its network of subnets.

Institutional Adoption & Access

Institutional access to the Bittensor ecosystem has increased steadily throughout the year, supported by new investment vehicles and the growth of subnet-level markets.

- Yuma Asset Management introduced a fund for accredited investors that offers diversified exposure to leading subnets.

- Stillcore Capital, founded by a group that includes investor and entrepreneur Jason Calacanis, launched a fund focused on subnet tokens.

- The Hippius subnet became the first to have its token listed on a centralized exchange, adding a new gateway for market participation.

Grayscale itself has also expanded its involvement in the ecosystem. The firm's Grayscale Bittensor Trust, which had been available through private placement since August 2024, recently began public trading on the OTCQX under the ticker GTAO.

Its listing makes it the first publicly quoted investment product in the United States designed to provide exposure to TAO.

"Bittensor is seeing rising network adoption and rising institutional investment. Grayscale Research believes that the combination of reduced TAO supply growth from the halving and increased TAO demand could serve as a positive catalyst for the Bittensor ecosystem."

Subnets

Subnets function as independently operated AI services built on the platform. Grayscale Research describes this structure as similar to a startup accelerator, with TAO acting as the economic engine that funds and incentivizes development.

"Bittensor functions like a 'Y-Combinator of Decentralized AI development,' with TAO funding the development of different subnets — akin to AI startups — building specialized products or services on the network."

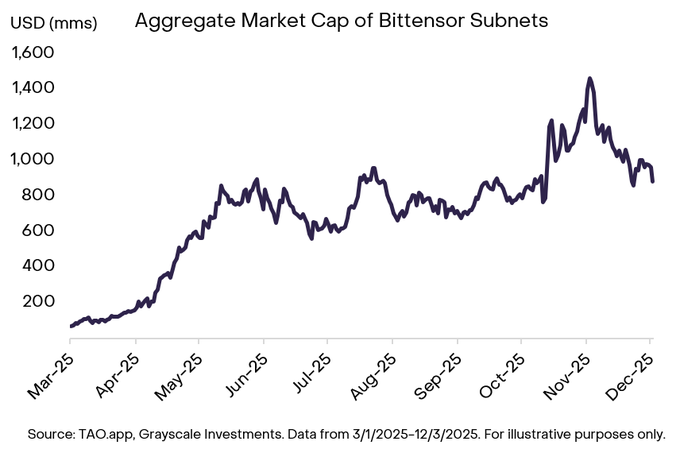

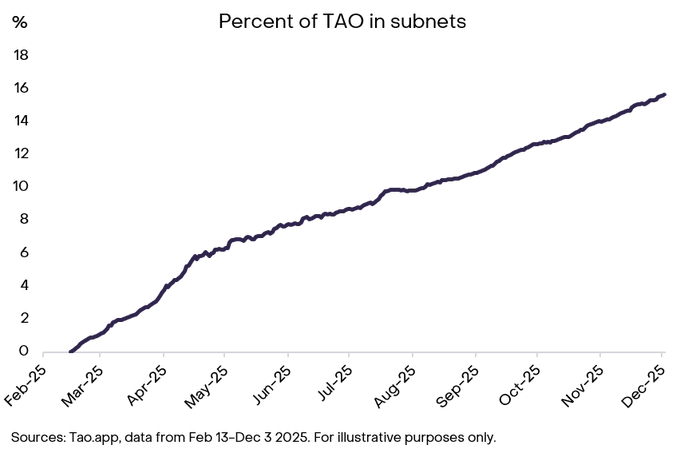

In February, the network introduced dynamic TAO, a change that allowed subnets to become directly investible for the first time. Since then, Bittensor has grown to 129 active subnets covering a wide range of use cases, including compute services, data storage, AI agents, and deepfake detection.

The aggregate market capitalization of subnet tokens has increased sharply since the feature went live.

Several subnets have shown early signs of product market fit. Chutes, the largest subnet by market cap, offers serverless inference for developers and recently ranked as the leading inference provider by usage on OpenRouter, a major AI model aggregation platform.

Another subnet, Ridges AI, produced an AI agent that outperformed Anthropic’s Claude 4 on benchmark coding tests.

🚨 Ridges Is Beating Billion Dollar Rivals $TAO 🚨

— Tao Portal (@TaoPortal) August 31, 2025

🟢 Ridges

• 80 % SWE‑bench

• $827K distributed on chain to miners to reach benchmark

• Valued at $78.34M

• No comsumer product launched yet

🔵 Anthropic / Claude Opus 4.1

• 74.5 % SWE‑bench

• $3.5B raise at $61.5B… pic.twitter.com/3ONO05Wuzm

Grayscale Research cites these examples as evidence that decentralized AI services built on Bittensor can compete with, and in some cases exceed, the performance of established centralized providers.

Grayscale’s Conclusion

Grayscale Research’s report concludes that the growth of Bittensor comes at a vital time in the AI industry's development, with the need for decentralized competitors to private corporations growing.They see Bittensor's first-mover advantage running its course with early signs of network effects taking hold. Overall, several factors could act as positive catalysts for the ecosystem and the price of TAO:

- TAO issuance reduction from the halving

- Continued success of subnets.

- The rising level of institutional engagement through new funds and the launch of the Grayscale Bittensor Trust on public markets.

2026 could be a watershed year for the ecosystem.

Are you prepared?

Read The Full Report

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. The information provided should not be interpreted as an endorsement of any digital asset, security, or investment strategy. Readers should conduct their own research and consult with a licensed financial professional before making any investment decisions. The publisher and its contributors are not responsible for any losses that may arise from reliance on the information presented.